|

Trend

Report: continued

The GWA is releasing results from their

2017 Industry Financial Survey, which is sent to

hundreds of shared workspace operators. Here are a few

of the key takeaways:

1. Private

Businesses and Landlords are getting into the flexible

workspace game.

This year we’re seeing flexible options

from landlords and private businesses grow faster than

anyone expected. According to a

recent Liquidspace report,

36% of the transactions on their platform are through

private businesses or landlords offering extra space

directly to consumers. Jamie Russo, Executive Director

of the GWA, says, “The Commercial Real Estate industry

may not have historically described itself as ‘nimble

and innovative,’ but that may just be the behavior that

we’re starting to see. This growth in transactions from

landlords suggests demand for coworking, particularly

from corporations, is growing. Landlords are

increasingly seeking creative relationships with shared

workspace operators in order to effectively activate

their flexible offerings.”

The predominant approach is still the

operator leasing the space, with 72% of respondents

following that model. 19% of the respondents own their

space, 3% reported a joint venture between the operator

and the landlord, and 1% reported a management contract

between the operator and the building owner. GWA

research anticipates seeing less leasing and more

operator/owner relationships in the next five years.

2. There

is an increasing focus on the user experience.

Two of the hottest buzzwords in the

workspace industry right now are “consumerization” and

“user-centered.” Everyone from landlords to corporate

real estate departments to temperature control start-ups

are focused on serving the “HDTV” consumer that expects

a high level of design and hospitality at the corporate

office, what the industry calls their “third space.”

3. Open

plan ≠ Coworking. Users are looking for productivity,

not just a place to network.

Today 80% of coworking spaces offer

private offices. While private spaces for individuals or

teams make startup-costs higher for the operator, the

demand seems to be growing for them.

Russo explains, “There is a big myth that

coworking means open workspace. When the industry

started to emerge in 2006, layouts were primarily open

space and the hosts were focused around the simple idea

of bringing people together to work. That approach

worked for a period of time, but today the makeup of

users and their space requirements is evolving.”

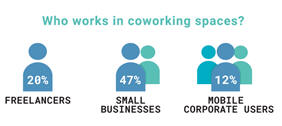

No longer are programmers and freelance

designers the core membership. The GWA data shows that

makeup of audiences today is 20% freelancers, 47% small

business, and 12% mobile corporate users.

Freelancers are the individuals that are

mostly doing computer work, so when coworking started it

was focused there and open plan made sense. However, the

demand for flexible office space is increasing through

the sharing economy and is creating a shift in demand as

corporate and small businesses users are on the rise. As

the makeup of users shifts, the needs for layout in

coworking spaces shifts, too. GWA data shows us the

importance of variety in spaces in order to create the

environment that makes coworking communities thrive. In

fact, today’s data tells us that conference rooms and

private offices are the most frequently offered spaces

across all flexible workplace types. The supply side is

reacting to that demand and creating more private

spaces.

Data from members of shared workspaces

indicates that the number two reason that people use

shared workspaces is productivity. Some may lump

networking under the productivity umbrellas (i.e.

productively chasing new business under one roof), but

it more likely means getting work done. For many,

getting focused work done is simply easier to do in an

area with four walls where you can control the stimuli

(chatter, people walking by, Skype calls, etc.) Still,

productivity looks different for different audiences,

and that is changing the face of these spaces.

Sourced and adapted from: http://www.huffingtonpost.com/entry/coworking-grows-in-2017_us_59764201e4b0940189700bc6

back home

|